GM. This is the Never Die Newsletter, where I share whatever crypto news and content I feel like, every week, short and sweet, right to your beautiful little inbox.

This week we have:

🎙️Hot Off the Mic: Why I’m All In On Crypto Going Into 2026

📰News: Whales Are Loading Up as BTC Slides

🌟Narrative of the week: Bitcoin’s 2025 Crash

NEWS📰

🐳 Whales Are Loading Up as BTC Slides

Bitcoin dipping under 90k is waking the big wallets up, with whale transactions spiking to 2025 highs. Retail is panicking, but whales are calmly stacking cheap BTC while everyone else folds.

🚨 DappRadar Shuts Down

DappRadar is closing after saying the platform is no longer financially viable, and its $RADAR token instantly sank 36%. No clarity yet on what happens to the DAO or token, but it’s clear the onchain analytics space has gotten crowded fast, with bigger players and institutions squeezing out smaller teams.

🦑 Kraken Files for IPO

Kraken quietly filed its IPO paperwork with the SEC after pulling in $800M in fresh capital, including a $200M check from Citadel at a $20B valuation. Funny timing though since the co CEO was insisting last week they weren’t rushing to go public.

🪨 BlackRock Eyes a Staked ETH ETF

BlackRock is moving toward a staked Ethereum ETF, aiming to boost returns beyond its already massive ETHA fund. Staking would turn the product into a yield machine, making it far more attractive to income hungry investors. With the SEC speeding up approvals, this could be one of the next big ETFs to hit the market.

💳 Mastercard Tries To Make Self Custody More Usable

Mastercard is rolling out verified, human readable aliases so people can stop using these long wallet addresses. Polygon runs the tech, Mercuryo verifies users, and a soulbound token locks in identity.

🔵 Coinbase Opens MON Sale to 80+ Countries

Coinbase is hosting Monad’s MON token sale, letting users lock USDC for 7.5% of supply with small buyers prioritized. Bold move since a US retail token sale sits right on the regulatory firing line.

Why I’m All In On Crypto Going Into 2026

In this video, I explain why I went all in on crypto and why I’m still convinced the top is nowhere close. The current dump isn’t a crash, it’s an opening. I walk through my full 5 year cycle thesis and the data showing this bull run is just getting started and pushing into 2026.

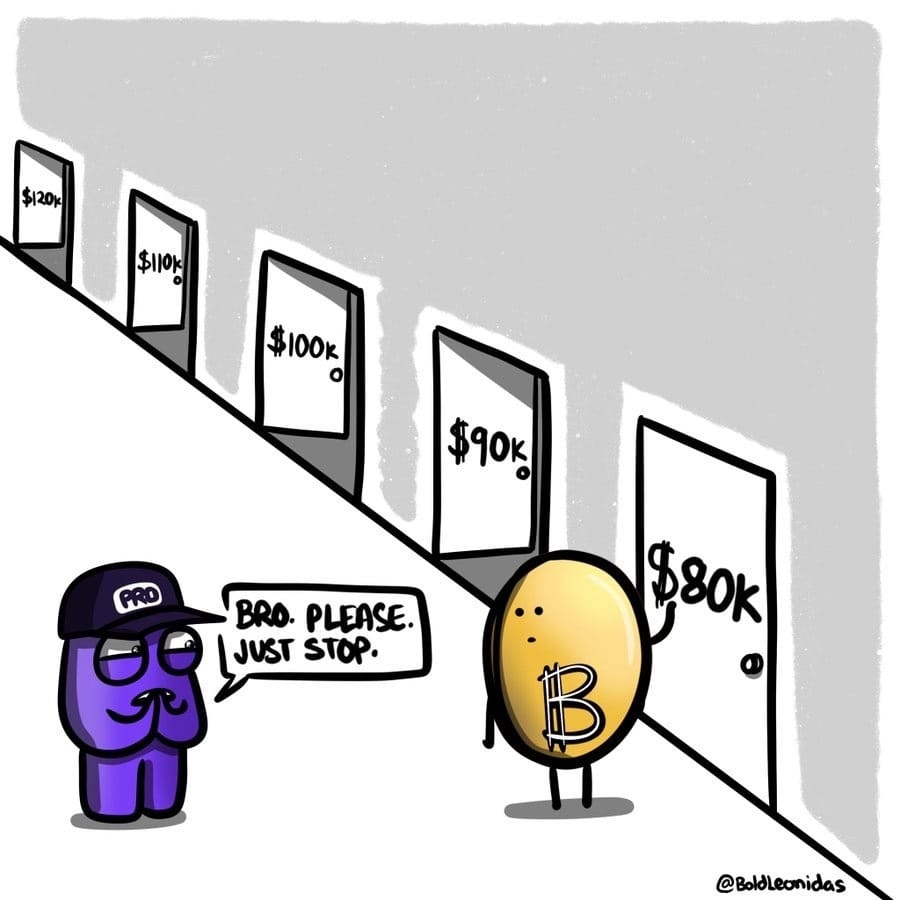

Narrative of the Week: Bitcoin’s 2025 Crash

Bitcoin has plunged ~31.5% from its all time high of $126K in early October to ~ $86K this week, wiping out over $1 trillion in asset value. For many ETF and institutional investors, gains made earlier this year have been evaporated. Here’s how it happened:

Fed Hawkishness: November Fed minutes highlighted sharp divisions over how quickly to ease policy, which slashed market odds of a December rate cut.

Thin Liquidity & Market Fragility: Post October liquidations left order books sparse, amplifying volatility.

Global Risk Off Sentiment: Weak Asian growth, Nasdaq retraces 6.6% and 4 year cycle believers off loading which all impacts BTC.

Reduced DATs Activity & ETF Inflows: Buying pressure from DATs like Strategy and ETF inflows has been slowing for some time.

Many expected 2025 to be crypto’s breakout year, aiming for a 2017/2021 style bullrun, but instead we got a mostly Bitcoin and AI driven spike. Harsh liquidity conditions and the Trump administration front running pain in the U.S. economy capped upside. As conditions ease next year with a likely pro crypto Fed, more rate cuts, potential tariffs dividends, capital is set to return to crypto. This positions the market for a true first 5 year cycle.

SOME TWEETS

MEME OF THE WEEK

TEMPERATURE CHECK📒

How Would You Rate This Week’s Email